During the aggressive globe of entrepreneurship, use of speedy, flexible financing might be the distinction between surviving and flourishing. No matter whether you’re functioning a cafe, launching a startup, or growing your retail operations, understanding your funding alternatives is critical. For entrepreneurs in the Sunshine State, Florida strains of credit history, Miami business capital, and specialised courses like cafe funding, bar funding, and service provider funds advancements present important guidance for sustained achievements.

At the guts of the motion is US Have faith in Small business Financial loans and Different Money Funding, located at 150 SE 2nd Ave, STE 701, Miami, Florida 33131. Which has a standing for empowering smaller to mid-sized corporations, this Miami-based mostly financial services business delivers Inventive funding solutions personalized to regional company wants.

Comprehension Florida Lines of Credit history

A business line of credit is a flexible funding selection that gives corporations access to a established quantity of funds, which they are able to attract from as necessary. Unlike a conventional loan, the place you get a lump sum, a line of credit score acts much more like a company charge card—ideal for taking care of money move, dealing with seasonal fluctuations, or seizing advancement options.

Enterprises in Florida advantage appreciably from these strains of credit history as a result of condition’s dynamic and at any time-evolving economy. No matter whether you might be in hospitality, logistics, or retail, a line of credit rating can offer a reputable money cushion.

Important Positive aspects:

Reusable use of funds

Fascination only on the quantity employed

Rapid liquidity for emergencies or alternatives

Helpful for inventory, marketing and advertising, payroll, or renovations

At US Rely on Business enterprise Financial loans, Florida traces of credit rating are customized to match the exceptional profiles of community corporations, offering a lot quicker approvals and aggressive interest premiums.

Miami Business enterprise Cash: Fueling Area Expansion

Miami has very long been a melting pot for innovation and entrepreneurship. As additional startups, dining places, and retail manufacturers emerge, the necessity for Miami small business money has never been greater. Common financial institutions might be restrictive, frequently demanding in close proximity to-best credit and prolonged paperwork. That’s exactly where different cash companies like US Believe in Business enterprise Loans and Alternative Funds Funding stage in.

Featuring a spread of economic solutions—small-phrase financial loans, gear funding, and working money innovations—this Miami-based mostly firm is with the forefront from the local funding ecosystem. They recognize the nuances of operating in South Florida, from seasonality to tourism spikes on the impact of hurricanes.

No matter if you’re a tech startup in Brickell or perhaps a boutique in Wynwood, use of speedy and flexible Miami organization cash is crucial—and US Rely on provides it with unmatched services and transparency.

Restaurant Funding in Miami: Hold the Kitchen area Running

Working a restaurant in Miami includes both of those benefits and dangers. The vibrant foodstuff scene attracts international visitors and native foodies alike, but the overhead expenditures—products, stock, staffing, and lease—can pile up quick. That’s in which restaurant funding will come into Participate in.

Cafe funding is a specialized form of financing made specifically for eateries and foods provider corporations. It’s generally additional flexible than bank loans and may consist of options like earnings-centered repayment, strains of credit, and merchant funds improvements.

US Believe in Enterprise Loans and Substitute Capital Funding allows restaurateurs secure the capital they need to:

Renovate or broaden eating Room

Improve kitchen area products

Launch marketing strategies

Handle payroll throughout gradual seasons

Obtain bulk stock or elements

With their local know-how and productive funding processes, US Rely on is becoming a dependable associate for restaurant homeowners seeking money stability and expansion.

Bar Funding: Raise the Bar with the best Capital

Bars and nightlife venues are cornerstones of Miami’s enjoyment financial state. But like dining establishments, bars facial area special worries—liquor licensing fees, seasonal profits fluctuations, and higher personnel turnover. Bar funding addresses these challenges with financing answers customized for bars, lounges, and nightclubs.

Bar funding options may contain:

Small-term Functioning funds financial loans

Equipment leasing for sound or lighting methods

Inventory financing for Liquor and provides

Renovation and growth resources

As a result of US Believe in, bar homeowners in Miami can entry funds promptly and with no purple tape. Their palms-on tactic signifies business people shell out less time buried in paperwork and even more time creating unforgettable activities for their prospects.

Miami Service provider Cash Progress: Speedy Cash Any time you Will need It

When time is with the essence, a Miami merchant income advance (MCA) features a super Alternative. This way of different funding presents an upfront lump sum in exchange for the percentage of future sales, earning repayment additional manageable during small-profits periods.

In this article’s why a merchant cash advance is likely to be right for your personal Miami small business:

Approval is predicated on income, not credit score

Resources are available in as little as 24–48 several hours

No mounted monthly payments—repayment fluctuates with all your product sales

Perfect for retail, eating bar funding places, e-commerce, and repair-based corporations

At US Believe in Small business Loans, the MCA approach is streamlined to support Miami’s quickly-going organizations. Whether you will need funds for advertising, selecting, or managing a shock expenditure, their MCAs provide the pliability and velocity these days’s business owners demand from customers.

Why Select US Have faith in Small business Financial loans and Option Money Funding?

Located in the center of downtown Miami, US Have faith in Small business Financial loans and Alternate Capital Funding (150 SE 2nd Ave, STE 701, Miami, FL 33131 | Workplace: (786) 726-3236) stands out for its personalized strategy and deep regional roots. Listed here’s what sets them apart:

✅ Rapidly Approvals – Get accredited in hrs, not weeks

✅ Flexible Terms – Custom funding plans that match your business goals

✅ Industry Specialization – Expertise in cafe, retail, assistance, plus much more

✅ Community Skills – They recognize the issues and prospects exceptional to Miami

✅ Great Help – A dedicated group to guide you in the funding approach

Irrespective of your credit record or just how long you’ve been in company, US Belief is devoted to helping you entry the capital you require—without the worry.

Ultimate Views

Navigating organization funding in Florida could be complex, but with the appropriate companion, it miami business capital will become an asset as opposed to a hurdle. Irrespective of whether you’re trying to find Florida strains of credit, Miami organization cash, or specialized restaurant funding, bar funding, or possibly a service provider cash advance, US Have faith in Business Loans and Different Funds Funding is your go-to useful resource in Miami.

Do not let an absence of capital maintain your organization again. Attain out nowadays to explore flexible funding alternatives created for your results.

???? Stop by Us: 150 SE 2nd Ave, STE 701, Miami, FL 33131

???? Contact Now: (786) 726-3236

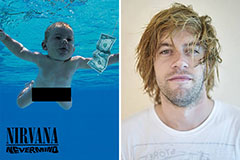

Spencer Elden Then & Now!

Spencer Elden Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!